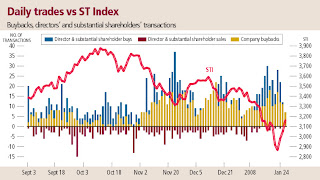

BOTH the buying and selling by directors and substantial shareholders surged during the steep correction in the market this month, as buyers moved in to support their companies' share prices while sellers aggressively cut their positions. A total of 74 companies recorded 196 purchases versus 17 firms with 41 disposals based on filings on the Singapore Exchange from Jan 21 to 25. The figures were sharply up from the previous week's 64 firms and 164 acquisitions against 11 companies and 29 sales. The fund manager sentiment remained positive with 17 institutional shareholders that posted 40 acquisitions versus eight asset managers with 33 sales. The figures were much higher than the previous week's 10 institutions and 29 purchases, against three asset managers and 21 disposals.

The sharp fall in share prices in the past few months prompted the heads of several listed firms to provide price support after share prices fell further this month.

Jade Technologies' president bought shares on the back of the 51 per cent drop in the share price since October 2007, while the chairman of UOB Kay Hian Holdings recorded a rare buy after the counter fell by 47 per cent. Not all directors bought shares during the price fall as ArianeCorp's chief executive officer (CEO) lowered his stake by 39 per cent after stock fell by 47 per cent.

On the funds side, several asset managers lowered their stakes to below 5 per cent in an effort to stem their losses on paper in the past few months. Legg Mason Inc lowered its interest in LottVision by 38 per cent to 4.9 per cent, while FMR LLC & Fidelity reduced its stake in Cosco Corporation to 4.9 per cent.

Jade Technologies Holdings

The 51 per cent drop in the share price of leadframes manufacturer, commodities & resources trader and real estate developer, Jade Technologies Holdings, since mid-October 2007 from 40.5 cents prompted group president and non-executive director Anthony Soh Guan Cheow to acquire an initial 5.5 million shares (direct) last Monday at 20 cents each. Mr Soh also has deemed interest of 445.7 million shares or 45.97 per cent of the issued capital.

The purchase was made after the group, along with listed firm E3 Holdings, announced that they would acquire a 49 per cent stake in oil refinery and 100 per cent stake in a 3 km land parcel in Jilin Province in mainland China. The purchase by Mr Soh was the first on-market trade by a director or substantial shareholder in Jade Technologies since July 2007.

The stock closed sharply lower at 12 cents on Friday.

UOB Kay Hian Holdings

Chairman and managing director Wee Ee Chao recorded his first trade in investment holding firm UOB Kay Hian Holdings in the past five years, with 1.29 million shares purchased last Tuesday and Wednesday at $1.74 each. The trade increased his deemed holdings to 117.9 million shares or 16.3 per cent. The rare acquisitions were made on the back of the 29 per cent drop in the share price since November 2007, from $2.42.

The chairman's purchases were significant as they were made at sharply higher than his sale prices in 2003. He previously sold 5.8 million shares from August to December 2003 at an average of 89 cents each. Those sales in 2003 were made at a profit based on the 2.7 million shares that he acquired in 2002 at an average of 65 cents each. The fact that he turned from a seller in 2003 to a buyer five years later at a sharply higher price indicates strongly that the stock is undervalued at $1.74 each. The stock closed higher from the chairman's last purchase price to $1.84 on Friday.

ArianeCorp

CEO Kea Kah Kim has reduced his stake in ultra high-capacity data networks provider ArianeCorp by 39.4 million shares or 39 per cent, after the stock fell by 47 per cent from 7.5 cents on Dec 28, 2007. The disposal was made last Monday at four cents each, which lowered his deemed holdings to 62.5 million shares or 8.2 per cent. The sale was made at sharply lower than his previous on-market purchase price, based on the five million shares that he bought from November to December 2004 at an average of 13.9 cents each. The stock has fallen sharply since January last year, from 13 cents to 3.5 cents on Friday.

LottVision

Legg Mason Inc ceased to be a substantial shareholder of digital video designer, developer and distributor, LottVision, on Jan 18 following the sale of 15 million shares at an estimated price of 15.5 cents each. The trade reduced its deemed holdings by 38 per cent - to 24.3 million shares or 4.9 per cent. The group lowered its interest to below 5 per cent on the back of the steep decline in the share price since July 2007, from 69 cents. Not surprisingly, Legg Mason's sale was made at sharply below its open-market purchase prices from April to August last year.The counter closed lower compared to Legg Mason's exit price at 13 cents on Friday.

Monday, January 28, 2008

Inside Markets: Both buyers, sellers more active during market slide this month

Posted by

Nigel

at

10:27 PM

![]()

![]()

Labels: Singapore Economy

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment